Products and Services

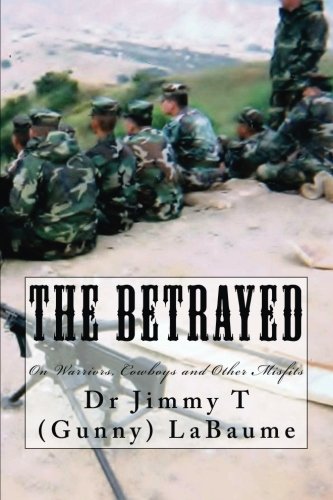

Support our web site and get an autographed copy of Dr LaBaume's most recent book

Products and Services

Risk Management: How to get rich from drought and bad cattle prices

International Agribusiness Consulting

International Agri-business Consulting

Introduction

There are three broad categories of businesses with respect to need and ability to enter international markets:

- Those that are still too small to consider an international presence

- Large corporations that already have their own, in house, personnel with international business expertise, and

- Those large enough to consider an international presence but not yet large enough to have their very own in house staff. This is the category to which we can be of the most assistance.

Whether you are a US company wishing to break into the export markets or a foreign company needing a presence in the USA, we can help.

We advise companies that represent the full spectrum of the marketing system—growers, manufacturers, wholesalers and retailers—and all manner of agriculturally related products and services. To name a few:

- All the latest in biotechnology

- Animal Agriculture Products – feed stuffs, nutritional and health care products, pharmaceuticals and veterinary medical supplies, livestock handling equipment and facilities, embryos, semen, etc.

- Plant Agriculture Products: Seeds, fertilizers, irrigation equipment, farm implements, water handling (irrigation) equipment, farm implements and equipment, etc.

- Other—processing and packaging technologies, equipment and supplies.

Why export?

There are many answers to this question and, as with out domestic consulting services, we do not offer “pre-packaged deals. Land & Livestock International, Inc (and its sister company Financial Planners International, Inc.) is here to help your company decide what will work best for you.

The potential for international trade is high for several reasons. Among them:

- Ninety-five percent of the world's population — two-thirds of total world purchasing power — is located outside the United States

- Emerging economies mean greater incomes and larger demand for high-quality specialty foods.

- Smaller countries have less space to produce food for growing populations. Through trade, companies of all sizes can meet these needs and find new markets for their products

- Lower tariffs and freer trade makes it easier for high-quality products to be exported around the globe.

We are available to help you determine your international needs and meet your business goals.

And the really nice thing is that, in addition to the above, an international presence can actually grow your company, it can be of great benefit to your personal financial situation as well.

International Investment in Agricultural Properties

Through our network of associates, we can represent our client in the acquisition of farms, ranches and other agri-business properties worldwide. Want to own a working cattle ranch in Paraguay or Mexico? How about a pineapple plantation or dairy farm in Honduras? How about an intensively managed cattle ranch in Colombia? How about a row crop farm, orchard or cattle operation in Argentina? Ever thought about owning a million acre cattle station in Australia? We have reputable associates in all of those places and then some.

Why might one wish to own such properties? Privacy and asset protection are two very good reasons.

International Asset Protection Strategies

With tax men cloning themselves and contingency fee lawyers on every street corner, the high net worth individual needs privacy and asset protection for his/her personal and business assets. In today's business world, litigious attorneys make the chances of a lawsuit for American business owners a real world fact.

Consider some of those facts:

- The US has 5% of the world's population, yet 70% of the world's lawyers.

- The US does not have a “loser pays” legal system. If you are involved in a lawsuit and win, you're still out your own legal expenses, so you still lose.

- In some other places, the loser of a lawsuit has to pay both his attorney fees and his opponents, making lawsuits much less frequent.

- Suing an offshore company is more difficult. Anyone suing an offshore company, may have to post a substantial, non-refundable ($25,000) bond just to get the case sent to a review board to determine whether or not it will even make it to a court. That is a strong shield of lawsuit protection.

Keeping your finances away from prying eyes, thus, preventing lawsuits, safeguarding your assets from litigation and the increased financial privacy are some of the many reasons for going offshore.

Any of the services offered by Land & Livestock International, Inc. (or its sister company Financial Planners International, Inc.) can be rendered anywhere in the world. There are a plethora of different offshore asset and privacy protection strategies ranging from a complete offshore plan (including investments, companies, bank accounts and trusts) to the opening of a simple bank account.

As with all of our services, we offer no “package deals.” We work with each individual client according to his/her personal needs, goals, objectives, financial and managerial proclivities, aptitudes and capabilities.

There are many offshore jurisdictions that have favorable laws that the US, Canada and the UK do not extend. These jurisdictions compete for international clientele by favoring privacy of ownership, privacy granted to officers and directors and non-recognition of foreign judgments.

The following is a description of some of the offshore strategies that may be implemented totally, singly, or in any combination according to the client's needs and abilities.

Offshore Company

Offshore incorporation is generally the first step to securing your privacy and protecting your assets. Offshore companies are businesses that have been incorporated outside of one's country of residence. These entities are formed for a number of reasons:

- Privacy and confidentiality

- Asset Protection

- Tax Savings (depending on your jurisdiction)

- Lawsuit Protection Flexible Business Laws

We can assist you in quickly and discretely forming a corporation (or limited liability company) anywhere in the world including those countries with legal systems that are some of the strongest privacy and protection jurisdictions.

We can assist you all the way through your corporation set up and organization including all of your organizational formalities—office programs, secure phone, fax and email, ATM/Debit and credit cards and opening an offshore bank account for your company for maximum protection.

Offshore Banking

The term “offshore bank” refers to any one of the many banking and investment institutions available in countries and jurisdictions other than the depositor's home country. While technically any bank can be considered an offshore bank when it meets the above criteria, the term is generally reserved for the banking institutions located in what are considered jurisdictions that have a high regard for the privacy of their depositors.

Since their origin, offshore banks have tended to be unfairly portrayed by both media and the home jurisdictions alike. The accusations have ranged from tax evasion to money laundering. But careful examination of the true purpose of an offshore bank account, and an unbiased examination of where illicit funds are truly held or “laundered” sheds light on the situation.

Other false accusations have centered on criticism of unsafe environments, poor regulation, etc. Again, these could not be further from the truth. Most Offshore bank account jurisdictions of any repute have very sophisticated, stable banking regulations, and because it is in their best interest to attract and keep depositors, these regulations are geared towards meeting the needs of the depositor. Many of these jurisdictions rely on foreign capital held in their banks as their primary source of capital and their only source of foreign investment.

One of the many benefits of holding an offshore bank account is that they are usually located in jurisdictions that provide substantial asset protection and confidentiality. These jurisdictions also often allow for a relaxation of restrictions with respect to the types of accounts available to depositors or investors and how they can be manipulated.

This amounts to decreased regulation. The more popular offshore jurisdictions often provide a substantial decrease in tax liability, whereas those in some countries, such as the US are generally taxed on worldwide income.

Some offshore banks with proven quantifiable benefits are located in island-states such as the Caymans or Channel Islands. Others are located in landlocked countries such as Switzerland which has been a tax haven for over a hundred years. However, there has been much chatter regarding the privacy of Swiss banks lately. However, the only Swiss banks that have had issues are those banks with branches located outside of Switzerland.

Those with purely Swiss locations continue to maintain strong privacy.

It is important that the proper jurisdiction be selected when deciding to bank offshore. The majority of the jurisdictions have sound regulations that are geared toward safeguarding deposits and maintaining confidentiality. Some weigh their benefits in taxation, while others in confidentiality, and so forth. Though they all offer a comparatively confidential and secure environment, banking goals should be outlined and the jurisdiction chosen accordingly. We can work with you on the selection of a secure offshore bank that offers an acceptable level of stability and safety.

Offshore Trust

The offshore trust is the absolute strongest asset protection tool available because it is the stopping point for frivolous lawsuits and creditors. For even greater flexibility and protection, you can combine the offshore trust with a company and bank account. This will provide the highest level of privacy and protection available in the world with an impeccable case law history.

An offshore trust is very much like a traditional trust in that it comprises a relationship or arrangement entered into by a person or group designated to be the “Trustee,” and a distinct person or group of people designated the “Settlor,” by which provisions are made in a binding, written legal form known as the “Trust Deed,” in order to hold title to assets and property, to manage said assets in accordance with the trust deed, in order to provide a series of benefits and distributions to a person or group of persons designated the “Beneficiaries.”

The trustee and/or the trust company charged with the management of the trust are bound by a fiduciary duty to uphold the agreement, and they agree to the rules and requirements set out by the trust deed. A trust is neither fish nor fowl, and though attempts at describing a trust often likens them to a corporation or foundation, they are unlike either; they are a trusting arrangement, supported by a binding written agreement, to provide for the benefit of the beneficiaries.

Once the decision to form the trust is reached, the settlor must then select the type of trust he wishes to form, its duration, and make important decisions on defining details. These details include deciding whether the trust is revocable or not, whether the trust will be discretionary or not, and to specify the rights, duties, obligations, and expectations of the trustee.

With respect to the revocable or irrevocable trusts, much as their names imply, they can either be revoked at any time with the terms for this outlined by the settlor, or they can have a pre-determined life span with no provisions for revocability, and only concluding when the terms of its creation as specified in the trust deed are met.

By contrast, a discretionary trust can fall under either category, and is defined as a trust with much built-in flexibility with respect to how the trustee handles distributions to beneficiaries, and even provides, in some instances, the trustee with rights to appoint or add beneficiaries. This relinquishes a lot of authority over the offshore trust to a trustee, however, and highlights the importance of the careful selection of a competent, well-reputed trustee or trust holding company with good references, a worthy reputation, and the experience necessary to successfully and faithfully fulfill and honor the terms of the trust.

Benefits of the Offshore Trust: The greatest portion of the confidentiality and protection from liability benefits of the offshore trust arise from the relinquishing of assets and title to property to the trustee The intent of the trust is to provide for the beneficiaries while the legal title passes to the trustee. Beneficiaries hold very strong rights with respect to the interests in the trust.

These trusts are usually formed in low-regulation jurisdictions with a reputation for the safeguarding of assets and confidentiality. Thus, the offshore trust also benefits from these features. Offshore trust assets are generally free from the suffocating tax burdens applicable in a settlor's home country. If the trust is for the benefit of the heirs of the settlor, it can provide protection from intense inheritance scrutiny and taxation. The offshore trust offers unparalleled confidentiality, increased protection from civil litigation and liability, and even from divorce or business dissolutions. They are also used by some for protection of assets in the event of home jurisdiction political or economic turmoil. With the exception of accusations of a severe criminal offense, it is extremely difficult for an outside entity to pierce the confidentiality shield inherent in a well situated offshore trust.

Where Offshore Trusts are formed: Although they often are, it is not absolutely necessary that an offshore trust be formed in a tax haven with lax regulations. The common denominator is that the jurisdictions base their trust regulations and statutes on the English common law (the very idea of a trust is an old English idea dating back to the Crusades). Other European jurisdictions that offer sound trust administration (Luxembourg, Malta, Switzerland, etc.) have adapted their statutes and regulations to conform to those based on the English common law.

Summary: The formation of an offshore trust requires realistic goals and sincere intent of a potential grantor as it may require substantial resources for establishment and maintenance.

The offshore trust provides substantial protection from untoward scrutiny, litigation, and civil strife. It should be apparent that while the cost of formation and maintenance may be substantial, the establishment of an offshore trust will provide for sound peace of mind for those needing to protect substantial assets or provide for their heirs in the long run.

Offshore Investing

Offshore investing can be very attractive for the discerning investor that wishes to explore other markets, shield his investments from onerous lawsuits, or grow his wealth in a confidential, secure investment not governed by the rules and regulations of his home jurisdiction.

At first glance, and especially to the uninitiated, offshore investments are often associated with tremendous risk in low-sophistication jurisdictions. However, these assumptions are grossly inaccurate. To the contrary, offshore investment vehicles are usually found in jurisdictions that have quite sophisticated rules, regulations, and policies that direct how deposits and investments are managed. It helps to remember that these are frequently the same jurisdictions that rely upon offshore capital for their banking institutions. Consequently, they are quite concerned that they maintain their reputations as low-regulation, high-confidentiality tax havens.

Benefits of Offshore Investing: Most American investors look to these Offshore investments for diversification of their investment portfolios, spreading their risk as widely as possible, and as protection of their assets from lawsuits.

Citizens of other countries may look for these same benefits. But frequently they also are looking for stability. Often they already bank with an offshore institution in order to safeguard their assets from political or economic turmoil in their home country. Thus, investing in these same jurisdictions is the next logical step in maintaining and growing their assets.

Just about anyone can invest offshore. Some countries, like the U.S. , prohibit offshore investment companies from directly soliciting business from their citizens—i.e. The U.S. government expressly prohibits offshore companies from soliciting Americans. However, the reverse is not (yet anyway) true. Americans can legally solicit offshore companies and conduct transactions with them.

These investments can be as sound and secure as any home-based investment, with the same inherent risk-benefit scales. They provide added value to any investment strategy or portfolio by lending diversification, flexible investment vehicles not available in the home jurisdiction, and substantial lawsuit protection.

If the link won't work for you, copy and paste the following email address onto the "To" line of your email: info@landandlivestockinternational.com